Summary

- The upcoming spin-off of Managed Infrastructure services appears to represent a major shift in the growth mindset.

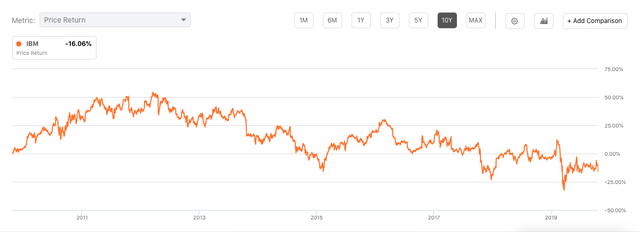

- However, the reality of it is very different, and the market knows that.

- There's going to be a long waiting period before we see meaningful revenue and earnings growth return to IBM.

IBM (NYSE:IBM) announced Q3-20 earnings results earlier this week, and it has left the market disappointed yet again with a lackluster quarter. Earlier in the month, the company announced its intention of spinning off its Managed Infrastructure Services business, which IBM says "will immediately be the world's leading managed infrastructure services provider," leaving IBM to be "a Leading Hybrid Cloud and AI Company."

Thesis: There's going to be a long waiting period before we see meaningful revenue and earnings growth return to IBM, so the only logical recommendation is "wait and watch."

It's hard not to connect the dots here and make a pre-post comparison of what has been and what lays in store for IBM and its future spin-off. The questions I aim to answer here are:

- What's broken now that will remain so after the spin-off?

- What's broken now that will be fixed after the spin-off?

- Will the spin-off help IBM achieve its hybrid cloud and AI goals?

We still have more than a year to go before the spin-off happens. Nevertheless, answering the questions above will give us a fair picture of the real situation underlying IBM's current performance and whether or not those problems will be addressed adequately by the spin-off.

Looking at Q3-20 results, it's clear that there's a lot of headway yet to be made on the revenue growth front, and the pandemic has not helped. As companies (IBM's clients, in particular, but also the overall Enterprise segment) focus more on short-term survival rather than investing capital for future growth, this poses a challenge to IBM that might not go away in a year. We see that reflecting on IBM's Q3-20 results as these companies defer purchases and delay certain non-critical projects in the short to medium term. According to IBM CFO Mr. Kavanaugh, echoing CEO Mr. Krishna's words:

"Clients' near-term priorities continue to include operational stability, flexibility and cash preservation, which tends to favor OpEx over CapEx."

So, it's every man for himself as IBM's clients struggle with their own internal problems, and IBM spinning off its managed infrastructure business isn't really relevant to those problems per se. As such, we're likely to see continued headwinds against top-line growth that have little to do with the spin-off.