Summary

- IBM delivered another quarter of revenue declines.

- The company has talked about increasing the dividends.

- But the risks of its giant debt load are increasing day by day.

- Looking for a helping hand in the market? Members of Conservative Income Portfolio get exclusive ideas and guidance to navigate any climate. Get started today »

International Business Machines Corporation (NYSE:IBM) is a stock we have examined a few times. At the crux of the bull argument has been that the company returns large amounts of cash to shareholders, via dividends and share buybacks. The bears have focused on it as the equivalent of a dying business which refuses to get traction. When we last wrote on it, we came down firmly on the side of the bears.

A large part of IBM's charm for investors comes from the high dividend yield and large buybacks. As we have pointed out, the buybacks are necessary to maintain status quo, and until the company can show organic growth over a multi-year period, we have to completely ignore the buybacks. The dividend is safe for now, but if we hit a recession anywhere between now and end of 2021, IBM's resolve to keep the high payout going might be severely tested in the face of peak gross margins in its growth sector. We would avoid the stock, as there are much better places to get a sub-5% yield if you don't need growth.

Source: Incessant Buyback Machine

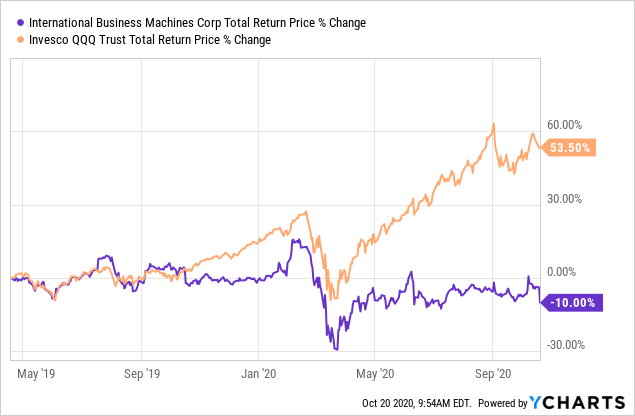

We consider our decision to be negative on this one, at least a partial success.

Data by YCharts

Data by YChartsA lot has changed over the last 18 months, and with Q3-2020 results out, we decided to dive in to see whether we can be proven wrong about this one.