Summary

- Last year Harry Markopolos pointed out GE's negative working capital. On a proforma basis, I estimate GE's working capital is still negative.

- I estimate GE's proforma working capital is -$7 billion. This is derived after reducing $20 billion in cash to pare debt.

- Accounting for negative working capital, GE's industrial net debt-to-EBITDA metric could be worse than realized.

- I estimate GE's total debt-to-EBITDA exceeds 6x, which would be considered highly-indebted.

- Based on several metrics, GE's balance should could be impaired. Sell GE.

- Looking for a helping hand in the market? Members of Shocking The Street get exclusive ideas and guidance to navigate any climate. Get started today »

Harry Markopolos. Source: San Antonio Express

Harry Markopolos. Source: San Antonio Express

General Electric (GE) remains one of the most maligned publicly-traded companies. Last year Bernie Madoff whistleblower Harry Markopolos looked askance at GE's balance sheet. Less talked about was Markopolos's claim that GE had negative working capital:

GE's 2018 year-ending working capital was minus $14.3B with BHGE and minus $20.3B without! Knowing this was critical information for investors, lenders, vendors, retirees, and regulators it was a willful omission on their part to not provide customary working capital reporting and disclosures in their 10-K. Do a word search on "working capital" and you will see GE spreads out its discussion of working capital over numerous pages of their 10-K and only discusses changes in working capital, but never gives you a true picture of how dire their financial position is.

Given GE's sizeable cash position, GE bulls likely dismissed any risks from negative working capital. Secondly, over time GE had the potential to close any such capital hole. Lastly, if negative working capital did not impact GE's credit rating then did it really matter?

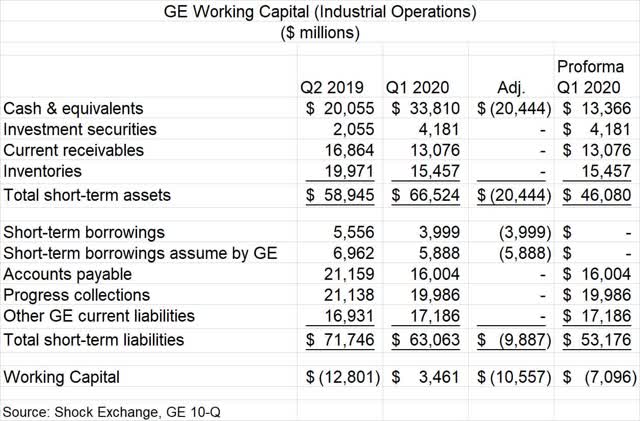

I think it matters a lot. First of all, I estimate GE's proforma Q1 2020 working capital remained negative. The following chart illustrates GE's working capital in Q2 2019, Q1 2020 and proforma working capital in Q1 2020.

At Q2 2019 and Q1 2020 I estimate GE's working capital was -$12.8 billion and $3.5 billion, respectively. On a proforma basis GE's current working capital would be -$7.1 billion. The company recently received about $20.4 billion from its sale of GE Biopharma to Danaher (DHR). Its Q1 2020 cash balance included the $20.4 billion windfall. I expected the company to use the proceeds to pare debt, which was not reflected on its Q1 balance sheet.

At Q2 2019 and Q1 2020 I estimate GE's working capital was -$12.8 billion and $3.5 billion, respectively. On a proforma basis GE's current working capital would be -$7.1 billion. The company recently received about $20.4 billion from its sale of GE Biopharma to Danaher (DHR). Its Q1 2020 cash balance included the $20.4 billion windfall. I expected the company to use the proceeds to pare debt, which was not reflected on its Q1 balance sheet.

The above adjustment assumes all of the proceeds go to repay $4.0 billion of short-term borrowings, $5.9 billion in short-term borrowing assumed by GE, and the rest goes to repay long-term debt. That would reduce GE's short-term assets to $46 billion, reduce short-term liabilities to $53.1 billion and reduce working capital to -$7.1 billion. This is important. The company's goal is to operate its industrial businesses with net debt-to-EBITDA of 3.5x or less. At year-end 2019, industrial net debt-to-EBITDA was around 4.2x. If you included additional debt to reflect any negative working capital then that ratio could have been worse than reported.