The value of a company is difficult to determine in the emerging energy technology sector, especially when they have no identifiable business plan nor sales strategy. With having had made public the revenue potentials for some of Fuelcell Energy’s molten carbonate fuel cell patents, it seems that its board of directors, which could not figure out a pathway to profitability, believes it now has business at hand.

Unfortunately for the common shareholder, the corporate general counsel was unable to identify the threats to their patent portfolio’s ability to create value from New Energy Opportunities’ previous release, “New #ChangeBigOil Dream Board for Fuelcell Energy” which is completely in line with its counsel’s track record.

Elections have consequences and investors do not need to be misled by the new CEO of an energy technology company that does not understand the industry or technology. While there are certainly a handful of pathways to capturing carbon while creating energy, do not be deluded by a misguided CEO. Waiting around for the U.S. Department of Energy and Exxon to give a company sales is not worth the time, and the recent turmoil in left-wing dominated states and cities that have blown their budgets will further strangle municipal clean energy projects.

Fuelcell Energy shareholders need to come to the honest realization that the KOSPO project is never going to pay off and that technology has forever been lost. South Korea is just as much of a pawn for the Chinese Communist Party as North Korea is and in further stunning insult to shareholders, Fuelcell Energy continues to publish patent after patent for further using their technology.

It is like you can hear the Chinese-accented English from halfway around the world. “So, anaerobic grinder attach here. Water attach here. These Americans so creative.” Stealing technology cuts down on development costs. There are two patents filed by Chinese concerns that predate Fuelcell Energy and Exxon patents that can be used for capturing carbon.

The most disappointing aspect of the company is the focus on selling power as the primary revenue stream. This is only a profitable channel for the company when they can dupe an environmentally motivated government entity into paying too much for electricity. Not being able to produce fuel cells at scale leaves Fuelcell Energy vulnerable to being priced out of the power market. Neither Exxon nor Toyota are going to pay up for technology that has already been stolen by the Chinese.

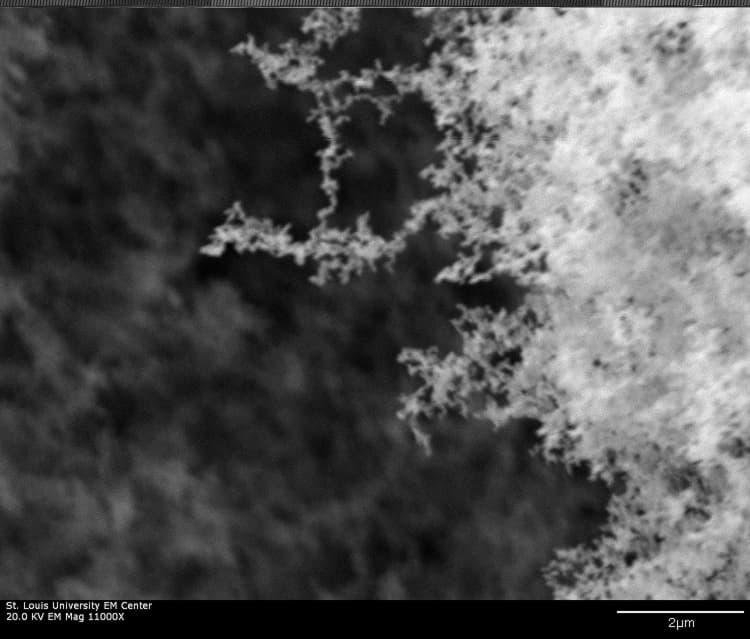

If management at Fuelcell Energy had been competent they would have recognized that Professor Suib has a patent filed and owned by the University of Connecticut and Honda Motor Company. The patent definitely covers an electrocatalytic cell “device and methods for producing carbon nanotubes” as well as “hydrocarbon containing components and oxygen containing components”. It is not conceivable Honda or Toyota would be interested in a non-performing fuel cell manufacturer with a near stagnant sales pipeline. The “accelerating revenue growth” comes from slashing overhead by 41% largely due to reducing “administrative and selling expenses”.

Meanwhile, the important work of yielding purified carbon nanomaterials from carbon dioxide has been progressing along another patent framework at C2CNT, LLC. They have an entrepreneurial-minded investor in Capital Power. Their board and management team seem to have the right stuff coming from a low margin energy market in Alberta, Canada. Their lithium carbonate electrocatalytic cell will also produce power as most quantum chemical reactions do. Investors need be cautious with their investment dollars when receiving fake news from management.

It is yet to be seen what may be yielded from registered complaints with the Securities Exchange Commission into the underhanded means by which the oil and gas industry board was allowed to count votes going into the April proxy vote. The issuance of shares to the employees and registration of another 75 million shares to be sold at the market means shareholder value could sink back to a dollar. New Energy Opportunities, LLC realizes how crucial it is for investors to allocate capital in order to bring about a greater future for all and will continue to point out the work needed to clear the pathway to King Solomon’s Mines.

About New Energy Opportunities, LLC

New Energy Opportunities, LLC is a startup consulting business for Opportunity Zone investing focusing on new energy technologies such as fuel cells, carbon capture, solar, vertical axis wind turbines and micro-grids. For more information, visit www.newenop.com or call John Beidle at 314-496-3432.