Summary

- Bristol-Myers Squibb has actually seen improved performance as a result of COVID-19. That's perfect as the company is paying off a big acquisition.

- BMY has a market leading position. The company is seeing its largest drugs continuing to earn and that growth could continue ever further.

- Looking at the long term, there's significant potential for the company to increase its multiples and therefore its market cap.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Bristol-Myers Squibb (NYSE:BMY) recently announced its 1Q 2020 earnings, seeing 13% YoY revenue growth rather than the 8% without special situations. That special situation? COVID-19. As we'll see throughout this article, BMY's impressive portfolio of assets, ability to grow through a downturn, and financial strength make it potentially the next quarter trillion dollar company.

Portfolio Improvements

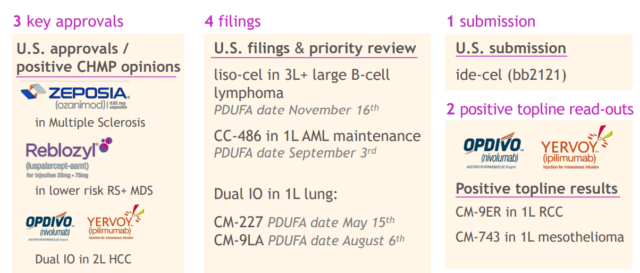

Bristol-Myers Squibb has seen a variety of submissions and approvals across its R&D portfolio YTD.

1Q 2020 Results - Investor Presentation

The company has seen approvals for Zeposia, Reblozyl, and Opdivo + Yervoy together. Together these drugs have more than $10 billion in peak sales, and expanded indications for them could help to expand that number. Opdivo, specifically, is important to keep a close eye on with its almost $8 billion in peak sales. Not only does the drug make significant cash flow, but there are also concerns its sales could decline.

As a result, each new indication the drug is approved for decreases the chance of that and could help keep sales higher for longer.

The company has also made a number of other regulatory filings and submissions, along with some promising drug readouts. Many of these individual drugs are expected to be blockbusters in their own rights. Liso-cel, for example, has yet to start its sales, but is already forecast for peak revenue of $3+ billion. Given Bristol-Myers Squibb's low valuation, its ability to even maintain its revenue and profits going forward will show it as undervalued.

1Q 2020 Results

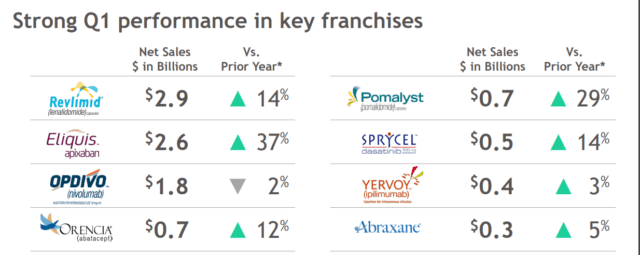

Overall, BMY had incredibly strong results and revenue across its portfolio.

1Q Performance - Investor Presentation

Overall, the company saw strong revenue growth across its key drugs supporting its $10.8 billion of revenue for the quarter. Revlimid and Eliquis in particular, blockbusters that make up more than half of the company's sales, saw double-digit annual sales. The company did see one YoY decline in sales, from Opdivo, but that ~$36 million YoY sales drop was more than made up by its other drugs.

More importantly, the company estimated the COVID-19 boost to quarterly sales at ~$500 million. If you take a look, it's worth noting that $500 million didn't move the needle enough to have saved the quarter from a down quarter - i.e. the quarter would have been good without COVID-19. The company's impressive quarterly performance, even if it's shorter term, is important because of its Celgene acquisition.