Joint Venture Adds 61 South Paramus Road to its Bergen County OfficePortfolio Along Garden State Parkway Corridor; Total Bergen Portfolio now1.4 MSF

Onyx Equities, LLC, in a joint venture partnership with Garrison Investment Group, announced the acquisition of the leasehold interest in61 South Paramus Road, a 285,000 square-foot office building located in Paramus, NJ, from seller Mack-Cali Realty Corporation.Thepartnership’s Bergen County portfolio affords current and prospective tenants the option to grow, relocate, and modify their space within the same geographic market through one point of contact.

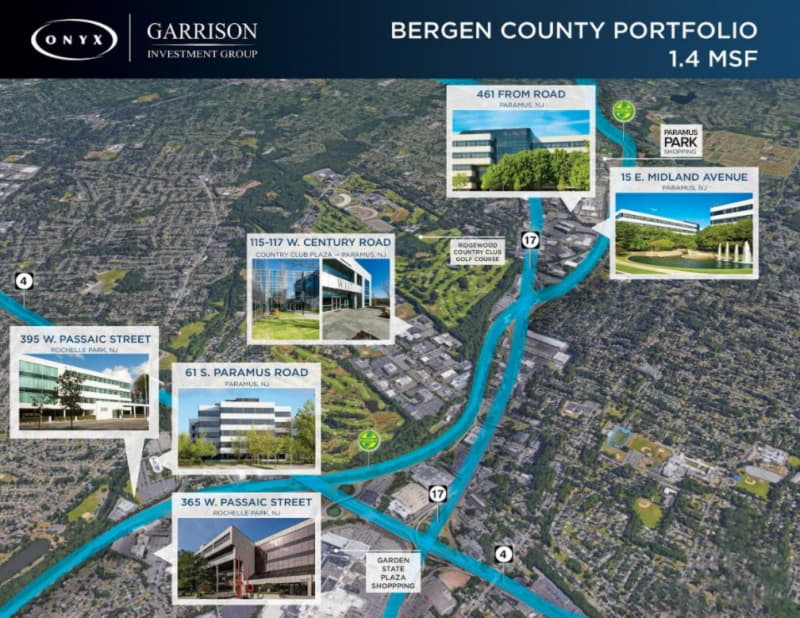

The partnership’s Bergen County portfolio is now comprised of 1.4 million square feet acrosssix assets located throughout Paramus and Rochelle Park, New Jersey,along the highly-desirable Garden State Parkway Corridor:

- 61 South Paramus Road, a five-story, 285,000-square-foot office building located in Paramus at Exit 161 of the Garden State Parkway.

- 461 From Road, a five-story, 260,962-square-foot office building located in Paramus at the intersection of Route 17 and Midland Avenue.

- 15 East Midland Avenue, a five-story, 260,832-square-foot office building located in Paramus just off Exit 165 of the Garden State Parkway.

- 365 West Passaic Street,a five-story, 218,492-square-foot office building located in Rochelle Park and situated at Exit 160 of the Garden State Parkway.

- 395 West Passaic Street, a four-story, 107,969-square-foot office building located in Rochelle Park and situated at Exit 160 of the Garden State Parkway.

- 115-117 West Century Road, a two-building office campus totaling 302,945 square feet, located in Paramus immediately off of Route 17 and the Garden State Parkway. The partnership’s common area renovationsare nearing completion here.

“61 South Paramus has the potential to be one of Bergen County’s best intuitional office buildings. It currently houses significant corporate operations and is situated in one of the mosthighly sought-after office locations.” said Stephen Sullivan, Chief Investment Officer at Onyx Equities. “We are pleased to have finalizedthis acquisition and look forward to implementing Onyx’s signature, value-add strategyin partnership with Garrison Investment Group.”

This deal is the fifth venture between Garrison and Onyx. “We look forward to delivering a modern workplace environment at 61 South Paramus Road that the tenants of Bergen County deserve, complete with high-end renovations, upgraded amenities, and a new Class A management team,”added Kristi Mazejy, Vice President at Garrison Investment Group.

All of these properties are located just off of several of the largest thoroughfares in the state, including Route 17, Route 4, Interstate 80 and the Garden State Parkway. In addition, the properties are situated near the largest shopping, dining and recreational centers in the area including The Paramus Park Mall and The Garden State Plaza.

Cole Schotz P.C. and Milbank, Tweed, Hadley & McCloy LLP represented the Buyer.

The investment sales team from Holliday Fenoglio Fowler, L.P. (HFF) comprised of senior managing director Jose Cruz, managing director Kevin O’Hearn, senior directors Michael Oliver and Stephen Simonelli and director Marc Duval, represented the seller, Mack-Cali Realty Corporation.

“The transaction further exemplifies the requirements by the investment community for core plus office buildings in the northern New Jersey markets," added Jose Cruz.

About Onyx Equities, LLC

Headquartered in Woodbridge, New Jersey, Onyx Equities, LLC is a leading private real estate investment, management and development firm. Since its founding in 2004, Onyx has acquired more than $2 billion worth of real estate assets throughout New Jersey, New York, Pennsylvania and Connecticut. Since 2008, the firm has owned and managed more than 60 million square feet of office, retail, and industrial properties. Driving Onyx’s success is its vertically integrated team of expertise in all facets of asset management, property management, construction administration and real estate marketing. For more information on Onyx Equities, contact the firm at 732-362-8800, or visit www.onyxequities.com.

About Garrison Investment Group

Garrison Investment Group is a middle market credit, distressed and asset based investor. The firm was founded in 2007 and is headquartered in New York. The firm is a multi-strategy investment manager that deploys capital in opportunities across Corporate Finance (lending and distressed), Financial Assets (commercial, industrial and consumer loans as well as hard asset lending and structured finance), and Real Estate (equity and debt). Its team of experienced professionals enables the firm to source and execute defensible transactions across its multiple investing disciplines.

About HFF

HFF and its affiliates operate out of 24 offices and are a leading provider of commercial real estate and capital markets services to the global commercial real estate industry. HFF, together with its affiliates, offers clients a fully integrated capital markets platform including debt placement, investment sales, equity placement, funds marketing, M&A and corporate advisory, loan sales and loan servicing. Holliday Fenoglio Fowler, L.P., HFF Real Estate Limited (collectively, “HFF”), HFF Securities L.P. and HFF Securities Limited (collectively, “HFFS”) are owned by HFF, Inc. (NYSE: HF). For more information, please visit hfflp.com or follow HFF on Twitter @HFF.