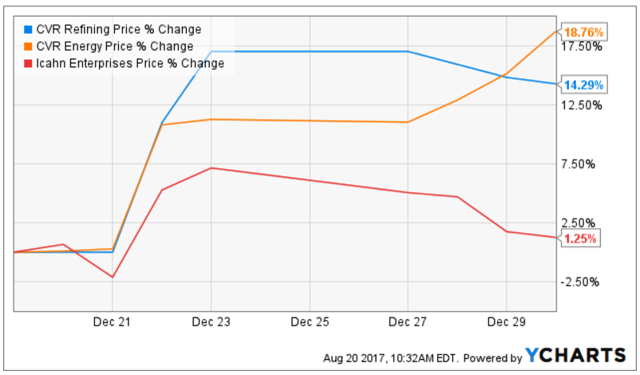

Last Friday evening's "bad news dump" contained a number of items of immediate interest to investors in Carl Icahn's majority-owned companies Icahn Enterprises (IEP), CVR Energy (CVI), and CVR Refining (CVRR). On Friday afternoon Mr. Icahn announced in an open letter to President Donald Trump that he would "cease to act as special advisor to the President on issues relating to regulatory reform." To recap, Mr. Icahn was named to the position by then President-elect Trump last December after months of publicly advocating for a proposal to modify the revised Renewable Fuel Standard [RFS2] biofuels blending mandate in a way that would have reduced the compliance costs of merchant refiners such as CVR Refining. The unit prices of the three firms, which had already rallied after Mr. Trump's unexpected election victory, shot higher (see figure) after Mr. Icahn's appointment was named on December 21 as the market began to expect that his RFS2 proposal would be successfully implemented now that he had the president's ear. The prices of the blending credits that refiners use to demonstrate their compliance with the mandate, meanwhile, began a descent that would ultimately result in them losing 67% of their value before finally stabilizing.

A major reversal has occurred over the last seven months as Mr. Icahn's proposed reform has failed to be adopted by the White House. The unit prices of Mr. Icahn's firms have steadily retreated from their earlier highs even as RIN prices have rebounded back to their own pre-appointment levels. Earlier this month, several financial media outlets reported that the White House intended to reject Mr. Icahn's proposal and, given this development, my initial reaction to last Friday's open letter was that Mr. Icahn's departure was driven by the recognition that he had failed to convince Mr. Trump to implement the reform.