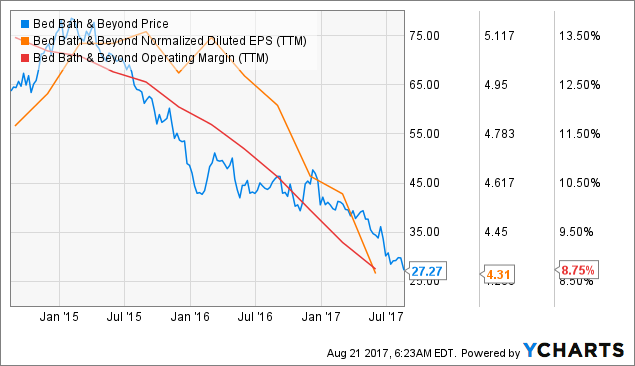

Though Bed Bath & Beyond (BBBY) is trading at all-time low valuations, potentially providing an opportunity for patient Deep Value investors, I am staying clear of the stock due to its lack of a moat and declining business performance metrics. The vulnerabilities in BBBY's business model have been exposed in recent years by the rise of e-commerce and the increasing heat of competition in the retail sector, causing the share price to decline amid eroding margins and EPS due to e-commerce and a heavy promotional retail environment:

The latest quarterly report illustrated the company's challenges, as BBBY missed on revenue and earnings while comps fell ~2% year over year:

The Company did experience increased softness in transactions in stores, as well as higher net-direct-to-customer shipping expense, coupon expense, and advertising costs.

This analysis reflects the company's thus-far unsuccessful attempts to offset the tide of declining store performance through increasingly heavy promotional efforts over the past five years and investments in mobile and internet business (buybuy Baby, Cost Plus World Market, pmall.com, and OneKingsLane). CEO Steven Temares reflected this approach when he recently announced: